Multifamily Bridge

Rates Starting at

10.99%*

Roc Capital Makes Bridge Loans Easy

Multifamily Bridge Terms

Loan Purpose | Multifamily (5+ units) bridge loan for purchase/delayed purchase of primary and secondary market residential investment properties that are stabilized or in need of renovation/value-add. |

Loan Term | 18 - 24 months, up to 36 months at lender discretion |

Loan Amount | $2M - $5M, $100K minimum value per unit |

Maximum Loan-to-Purchase-Price (LTPP) | Up to 75% LTPP |

Maximum Loan-To-Value (LTV) | Up to 75% LTV |

Maximum Loan-To-Cost (LTC) | Up to 70% LTC |

Minimum DSCR | 1.25x exit DSCR |

Recourse | Full Recourse |

Minimum FICO | 725 |

Renovation Ratio | Limited to 50% or less of the purchase price |

Occupancy | Minimum 50% of units occupied for properties with unit count ≥ 10 100% residential, no mixed-use or owner-occupied units |

Markets | Available in select Northeast markets |

Channel | This product is currently only available as a retail or direct-to-borrower loan. |

Foreign Nationals | Not eligible |

Borrower friendly terms and process

Common-sense underwriting; high leverage at attractive rates and non-recourse options available.

Flexible one-stop multifamily financing

You and your borrowers can take advantage of Roc Capital’s seamless bridge-to-perm financing, enabling your clients to take a bridge loan to acquire, renovate, and stabilize a multifamily property, and then easily transition into a long-term loan option.

lenders

US states

in funded loans

Working with Roc Capital® is as

easy as 1-2-3

Sign Up

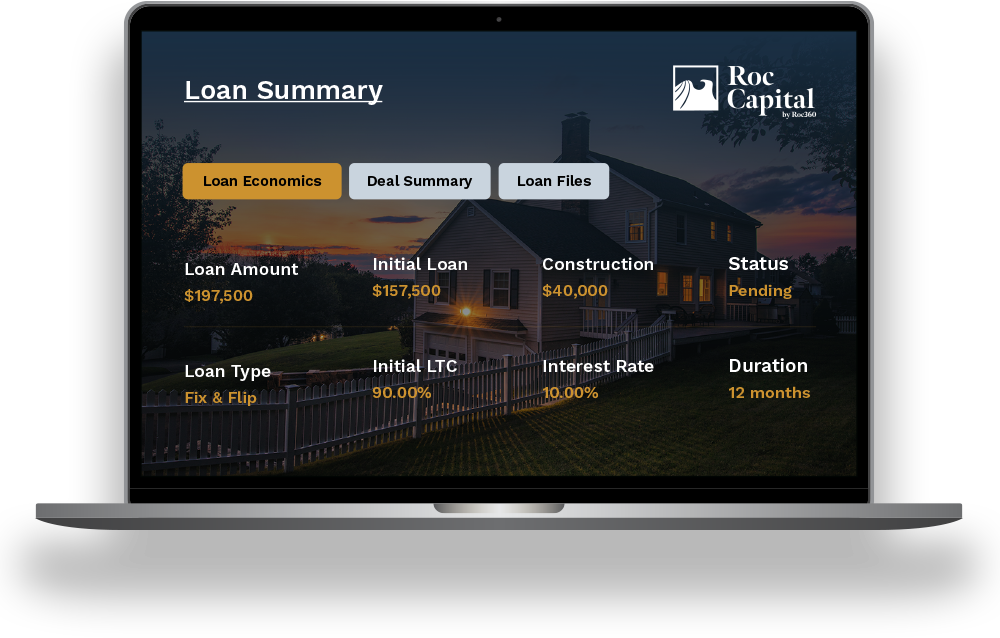

After you receive your login, you will be able to submit deals directly through our online portal.

Onboard

We fund your deals

Our relationship managers will get your deals funded fast!