Rates are unlikely to move lower any time soon

Roc Capital can help you adapt and thrive

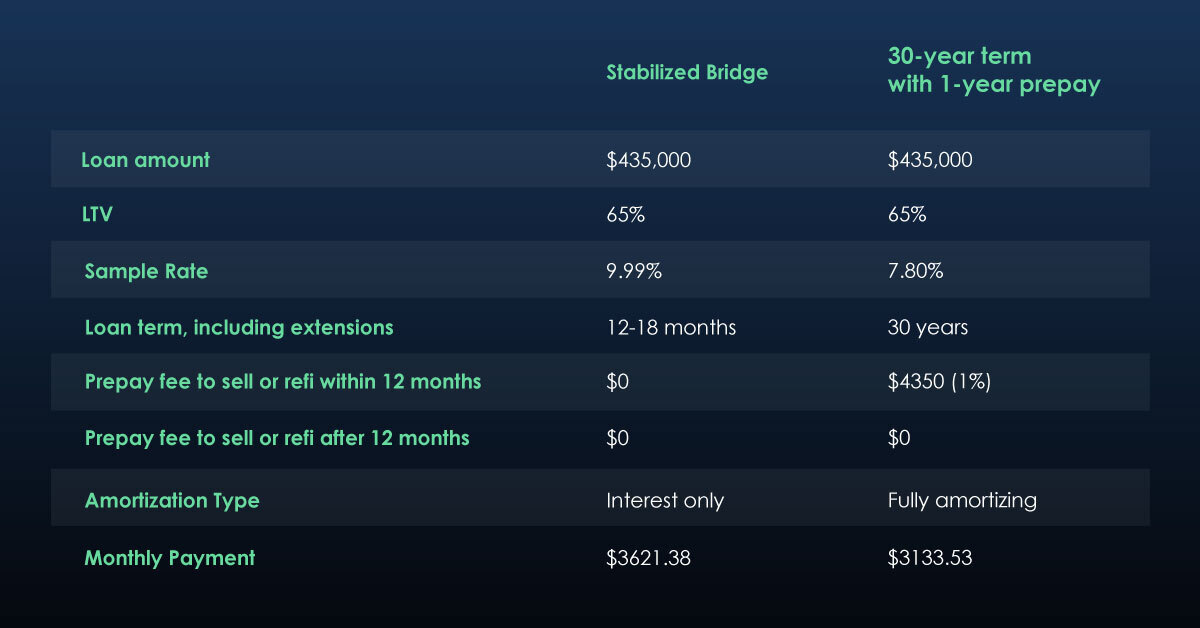

- Stabilized Bridge Loans: short term financing for rent-ready properties, with no prepayment penalties and cash out options, ideal for quick close transactions on properties that require no renovations or to refinance existing finished projects that have short term loans that are coming due.

- 1-year PPP (prepayment penalty) on 30-year Term Loans: long term financing on rent-ready properties with free prepayment after 12 months, for borrowers that are more rate sensitive and/or for those that want to avoid the balloon payment risk associated with short term bridge financing.

Sell in an uncertain market; or rent and refi?

- Stabilized Bridge. The borrower can take our 12-18 month Stabilized Bridge loan with no prepayment penalty. This bridge loan would have a higher interest rate than a term loan, but provides complete flexibility on prepayment and potentially lets the borrower take some cash out in the process, based on the property’s ARV and market rent.

- 30-year Term Loans with 1-year Prepay. If the borrower’s time horizon for exit is at least a year, (e.g. they have a tenant with an annual lease and are not likely to sell the property within a year), the 30-year term loan option with free prepayment after 12 months could be the more attractive option in this scenario. Borrowers get the twin benefits of a lower rate compared to an equivalent bridge loan option and the flexibility of remaining in a 30-year loan if rates continue to stay high or go higher a year from now, thus avoiding the balloon payment risk associated with a bridge loan.

Roc Capital is here for you.

We’re here to fund your loans. Our white label table funding model continues to persevere in these times as it did during the dark days of COVID. We focus on managing risk while you continue to originate great loans. We can help your lending business stay balance-sheet-lite. We fund your loans in your company name reliably and consistently. Our products and services have been designed specifically to ensure your success and that of your customers. Our technology suite, full back-office support, and concierge service provide you with unmatched resources in the market. Our entire team of over 350 people has your back and we will work tirelessly for you.

Want to learn more about Stabilized Bridge, 1-year PPP 30-year Term or our other products that help you ride out these rough times? Get in touch with us today!