Multifamily Bridge

Rates Starting at

10.99%*

Roc Capital Makes Bridge Loans Easy

Multifamily Bridge Terms

Minimum Guarantor Fico | Mid-Score of 680 |

Markets | Primary, secondary and tertiary |

Loan Term | 12 to 24 months |

Recourse | Loans ≤ $2MM: Full Recourse Loans > $2MM: Full Recourse or Limited Recourse with bad-boy carveouts Completion Guaranty/Reserve Replenishment Guaranty when applicable |

Loan Types | Interest Only | Fixed/Adjustable Rate Mortgage Options |

Experience | Prior multifamily property ownership experience required |

Loan Amount | $500K - $5MM |

Loan Purpose | Multifamily bridge loans for purchase or refi of small and middle-market investment properties (5+ multifamily units) that are stabilized or in need of renovation/value-add. |

Property Type | 5+ unit Multifamily, min $35,000 per door Acceptable properties are Class A, B and C grade. Class D properties will be considered on a case-by-case basis |

Maximum Leverage Loan-To-Cost (Ltc) Loan-To-Value (Ltv) Cost Is Purchase Price Amount | Up to 75% of purchase price and 100% of renovation costs subject to 80% total (LTC) | 70% of stabilized value (LTV) Cash-out refi 65% |

Borrower Recourse | Recourse and Non-recourse. Non-recourse option will have standard carve-outs; availability will be determined on a case-by-case basis. |

Foreign Nationals | Allowed with established US credit subject to 55% stabilized LTV max |

Borrower friendly terms and process

Common-sense underwriting; high leverage at attractive rates and non-recourse options available.

Flexible one-stop multifamily financing

Originate and lend nationwide

lenders

US states

in funded loans

Working with Roc Capital is as

easy as 1-2-3

Sign Up

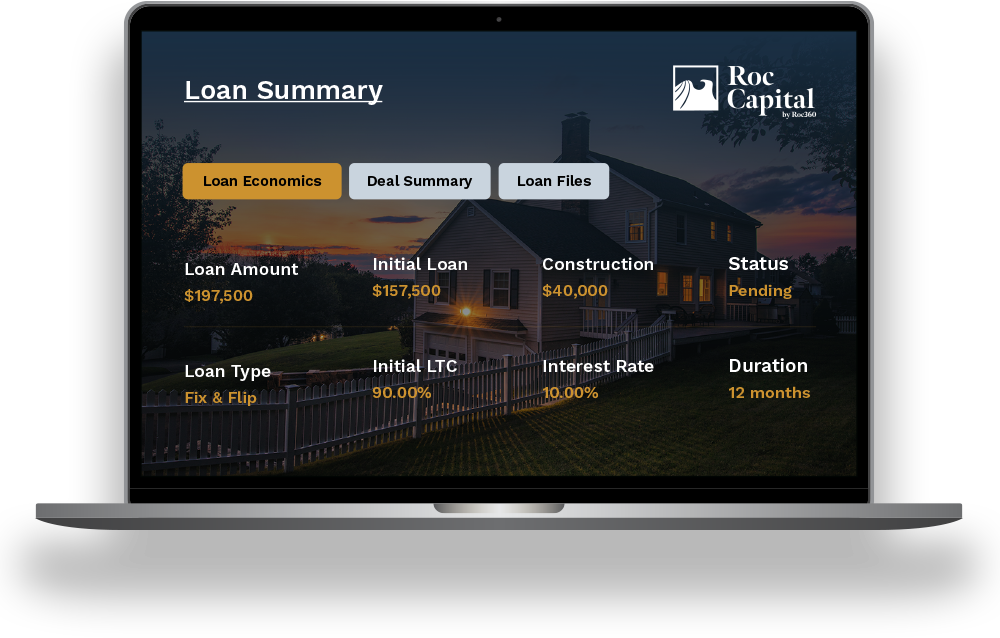

After you receive your login, you will be able to submit deals directly through our online portal.

Onboard

We fund your deals

Our relationship managers will get your deals funded fast!