Multifamily Term

Rates Starting at

6.81%*

Roc Capital Makes Multifamily Term Loans Easy

Multifamily Term Terms

Maximum Loan To Cost | If owned < 3 months, 70% of Total Cost Basis If owned between 3-6 months, additional 5% haircut on Max Eligible LTV |

Maximum Loan To As-is Value (subject To Minimum Fico) | Purchase/Rate-Term Refinance: 70% Cashout Refinance: 70% |

Minimum Guarantor Fico | Mid-Score of 680 |

Recourse | Full Recourse or Non Recourse with bad-boy carveouts and Pledge of Equity |

Loan Types | 30-Year Fixed Rate Mortgage, OR 5/6, 7/6, 10/6 Hybrid ARMs (Partial IO or Fully Amortizing) |

Loan Amount | $250,000 - $3,000,000 |

Term Length | 30 Years |

Property Types | 5-8 Unit Residential Properties |

Minimum Debt Service Coverage Ratio (net Cash Flow/debt Service) | 1.20x - 1.40x, based on subject market classification (Top, Standard, Small, Very Small) |

Lease Requirements | Minimum Occupancy Rate of 90% by Unit Count Leased Units: Lower of (i) In-Place Rent & (ii) Market Rent Unleased Units: 90% of Market Rent (Purchase Loans only) |

Attractive alternative to traditional bank and agency financing

Common sense underwriting

Funding for mixed use properties, including singles and portfolios

lenders

US states

in funded loans

Partners

Working with Roc Capital is as

easy as 1-2-3

Sign Up

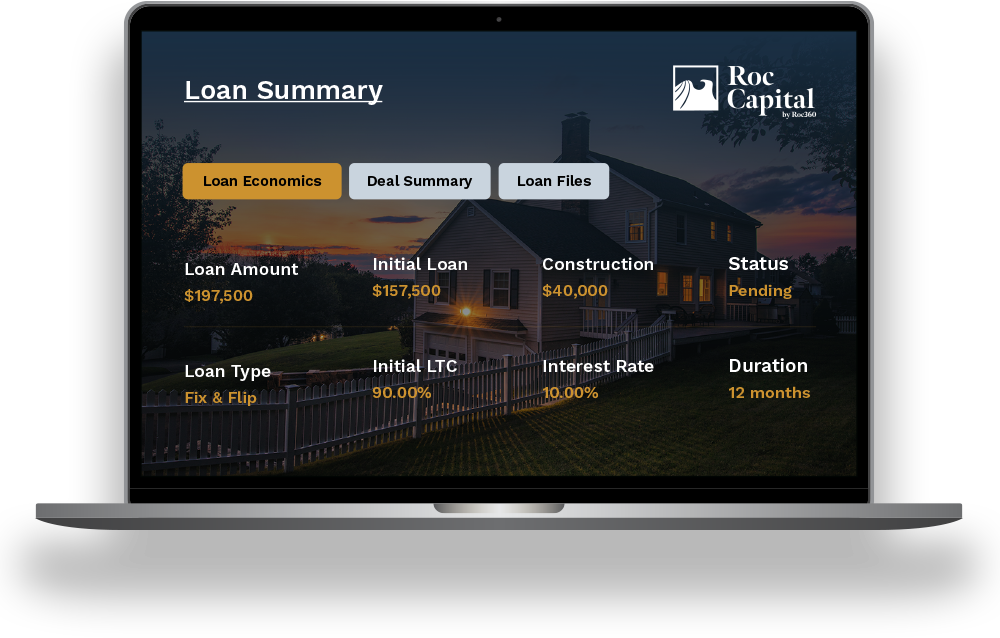

After you receive your login, you will be able to submit deals directly through our online portal.

Onboard

We fund your deals

Our relationship managers will get your deals funded fast!