RENTAL PORTFOLIOS

Rates Starting at

5.39%*

Roc Capital® Makes Portfolio Loans Easy

Roc Capital® Rental Portfolio loans provide you with a reliable funding source for your landlords against a collection of 1-4 family houses.

Rental Portfolios Terms

Amortization and Rate Options | Fixed and Adjustable rate options in addition to partial interest only and fully amortizing options |

Lease Requirements | Minimum occupancy rate of 90% by unit count Leased Units: Lower of (i) In-place rent & (ii) Market rent Unleased Units: 90% of market rent |

Recourse | Full Recourse with Pledge of Equity of Borrowing Entity |

Loan Purpose | Blanket loan for purchase, rate-term refinance, or cash-out of a portfolio of rental properties |

Minimum FICO | 680 |

Borrower Type | Entity required |

Property Type | Non-Owner Occupied: Single family residences (SFR) 2-4 unit properties Warrantable condos Townhomes PUD |

Minimum Debt Service Coverage Ratio (net cash flow/debt service) | 1.05x |

Vacancy Minimum | Min. 90% occupancy rate by unit count |

Rural Properties | Not permitted |

Foreign Nationals | Eligible at maximum 65% LTV |

Loan Amount | Minimum Property Value: $72K Maximum Loan Amount: $2MM |

Property Restrictions | No vacation or seasonal rentals |

Maximum Loan-To-Value (LTV) | Up to 80% on purchase and rate/term refi. Up to 75% on cash-out |

Seasoning Requirement (to use value vs. cost basis) | 90 days |

Minimum FICO | 680 |

The widest range of terms and options

5, 10, and 30-year term, fixed rate or hybrid ARMs, partial IO available, non-recourse.

Ultra competitive rates and leverage

Borrower-friendly rates and full leverage available 90 days post purchase with no further rent roll seasoning required.

Flexible funding for growing portfolios

By funding portfolios from a minimum $100K property value, up to $2MM, Roc Capital® lets you accommodate your landlord client’s real estate needs for their growing portfolios.

lenders

US states

in funded loans

Working with Roc Capital® is as

easy as 1-2-3

Sign Up

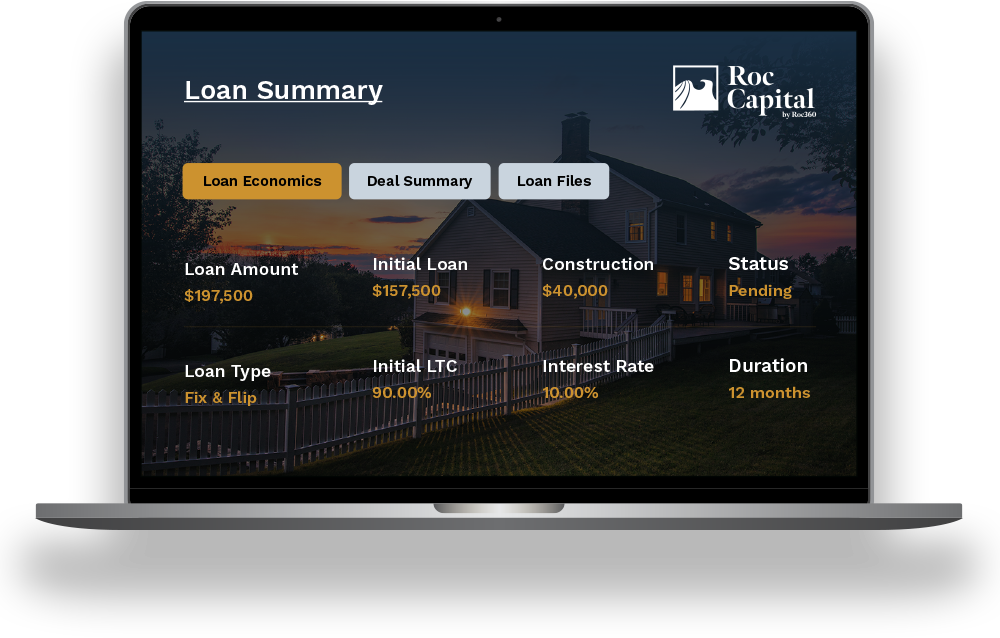

After you receive your login, you will be able to submit deals directly through our online portal.

Onboard

We fund your deals

Our relationship managers will get your deals funded fast!